1. Reduced Costs and Streamlined Processes

Digitizing banking services can help banks reduce operational costs, streamline processes and enable end-to-end integration. It can lead to a higher accuracy of transactions and a faster turnaround time for providing services to customers. Banks leverage this benefit to offer differentiated and more timely services to their customers.

2. Revenue Growth Opportunities

Personalized digital banking experiences can offer growth opportunities for banks in the form of cross-selling or up-selling of financial products and services. By analyzing customer data, banks can offer targeted product recommendations and personalized financial advice. AI can also be used to enable business transformation as well as create predictive models that anticipate customer needs.

3. Seamless Customer Journeys

Consumers would prefer digital channels for transactional activities and connect to bank’s branch for hi-tech interactions. Digital banking experiences provide customers with seamless journeys across multiple channels. It leads to greater trust and customer satisfaction, as customers can complete transactions on their own terms. Banks capitalize on this benefit by providing customers with easy access to information and services that they require.

4. Increased Operational Efficiency

The digitalization of banking services can provide banks with the ability to perform a wide range of functions quickly and efficiently. It leads to greater agility and responsiveness, which can be especially important during crises or periods of increased demand. By providing efficient services, banks can build confidence as well as trust with their customers, resulting in stronger relationships and increased business growth.

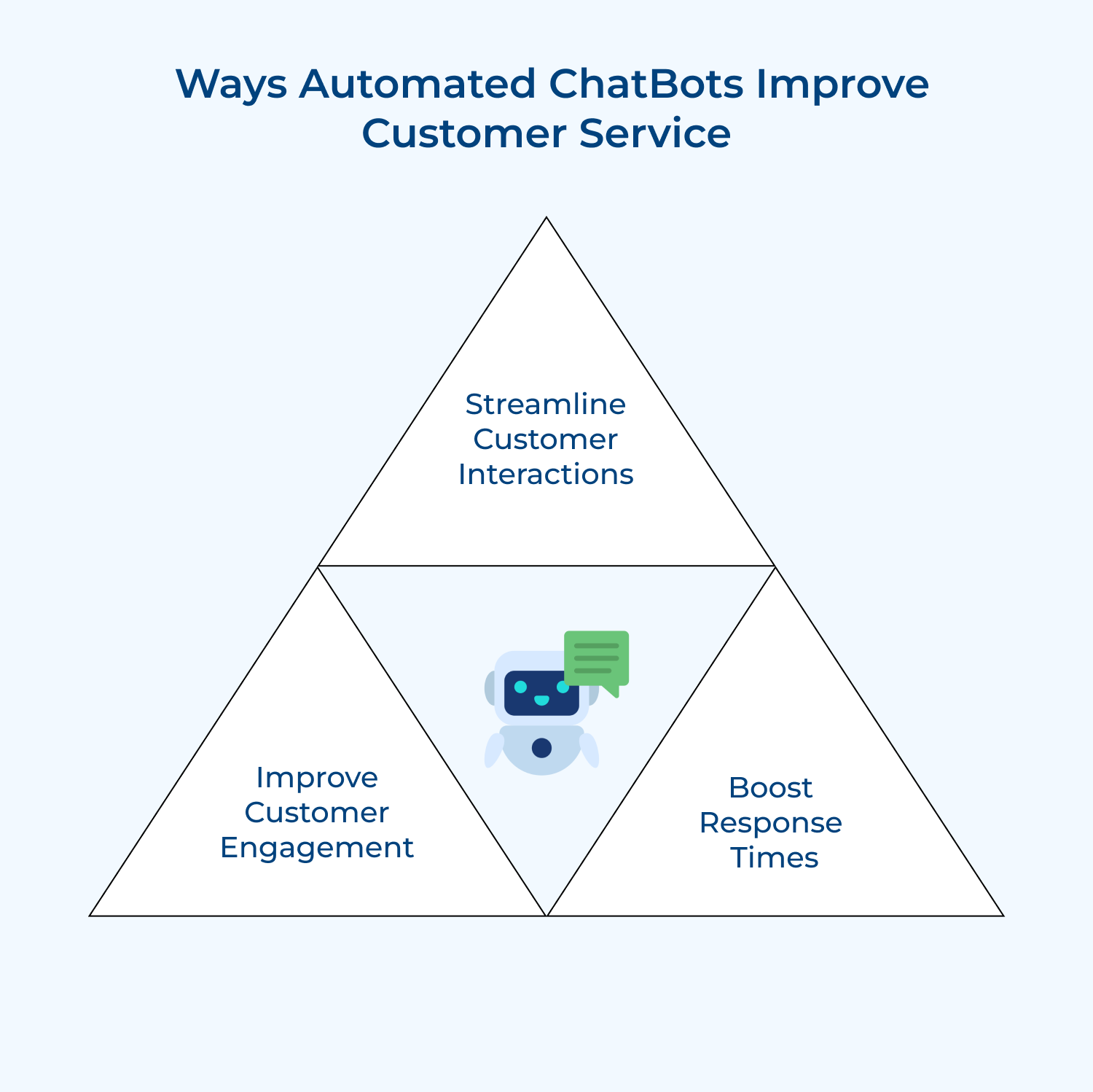

5. AI-Enabled Business Transformation

Artificial intelligence can improve the digital banking experience by enabling better fraud detection, chatbots for customer service and predictive analytics for more informed decision-making. The transformation allows for revenue growth opportunities for banks from innovative products and services that better meet the demands as well as behaviors of modern customers.

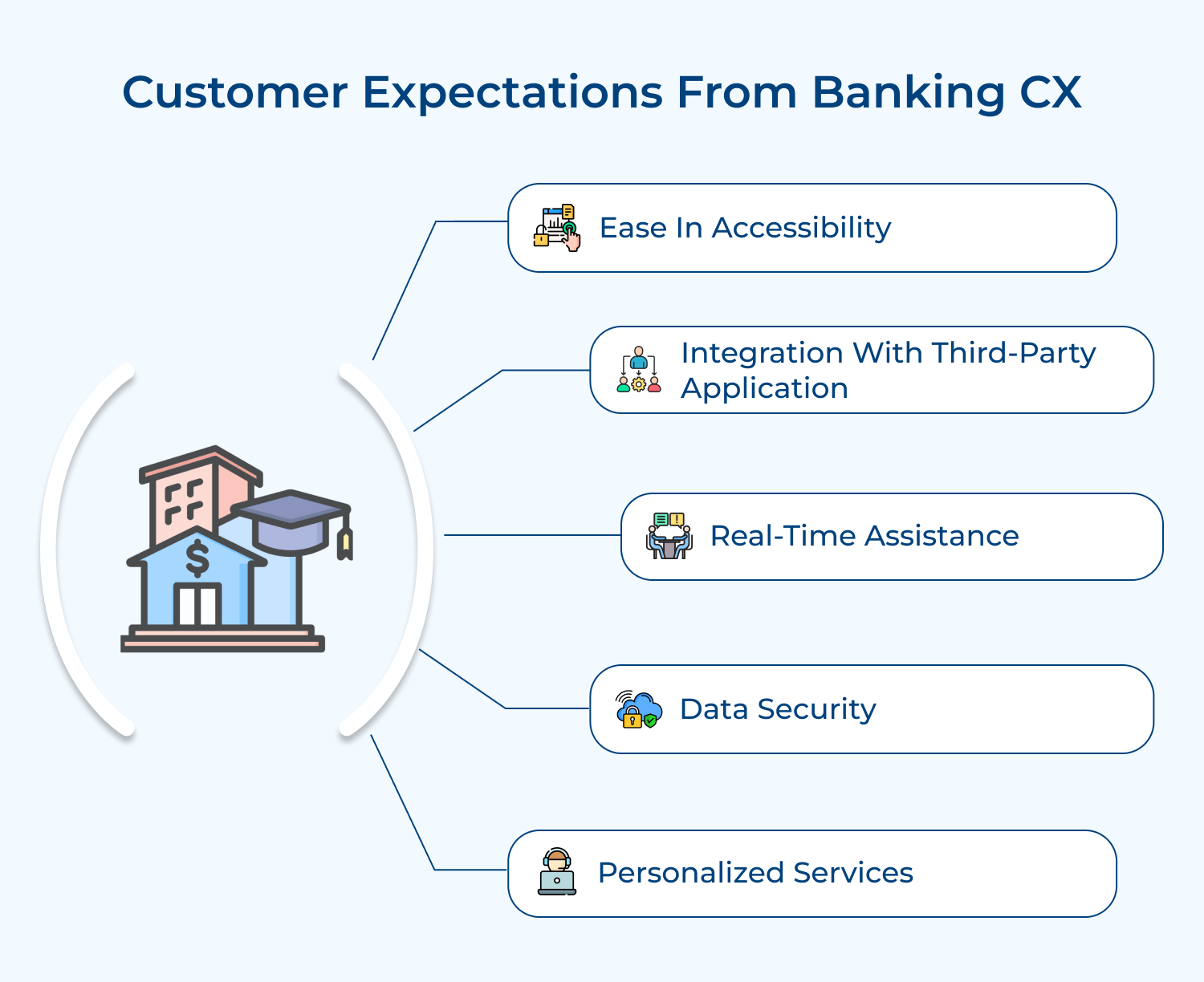

What are The Customer Expectations From Banking Institutions?

Customers have high expectations of their banking institutions to deliver an excellent digital experience. Customers now prefer banks that provide them with a digitized banking experience that makes their lives easier and more convenient.