1. Calculate the Average Revenue per Customer (ARPU)

The first step in calculating customer equity is to determine the average revenue generated by each customer. To do this, divide the total revenue generated by the number of customers. For example, if a company generated $100,000 in revenue from 500 customers, the ARPU would be $200 ($100,000 / 500 = $200).

2. Determine the Average Cost per Customer Acquisition (CACA)

Next, calculate the average cost of acquiring a new customer. This includes all marketing and sales expenses related to acquiring new customers. Divide the total acquisition costs by the number of customers acquired. For instance, if a company spent $50,000 to acquire 200 customers, the CACA would be $250 ($50,000 / 200 = $250).

3. Calculate the Average Customer Retention Rate

The retention rate refers to the percentage of customers that continue to do business with a company over a specific period. To calculate the retention rate, divide the number of customers retained by the total number of customers at the beginning of the period. For example, if a company started with 500 customers and retained 450 customers at the end of the period, the retention rate would be 90% (450 / 500 = 0.9 or 90%).

4. Estimate the Customer Lifetime Value (CLV)

Customer lifetime value is the total revenue that a company can expect to generate from a single customer over the course of their relationship. Calculate CLV by multiplying the ARPU by the average customer lifespan. For example, if the ARPU is $200 and the average customer lifespan is 5 years, the CLV would be $1,000 ($200 x 5 = $1,000).

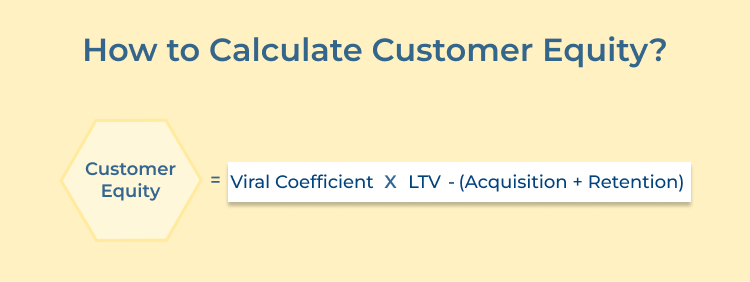

5. Calculate Customer Equity

Once you have calculated the ARPU, CACA, retention rate and CLV, you can determine the customer equity. Subtract the CACA from the CLV and multiply the result by the number of customers. Using the example values above, the customer equity would be $550 ((($200 – $250) x 500 = $550).

Best Examples of Customer Equity

In simple terms, customer equity is the total value of a customer to a company over the course of their relationship. Here are the best live examples to help you understand better:

1. Apple Inc.

Apple is known for its strong brand loyalty and customer retention. With a range of products and services, Apple has built a loyal customer base that consistently purchases new products as well as upgrades. By focusing on customer satisfaction and innovation, Apple has been able to increase its customer equity over the years.

2. Amazon

Amazon is a prime example of a company that prioritizes customer experience. Through its personalized recommendations, fast delivery and excellent customer service, Amazon has built a loyal customer base that generates significant repeat business. The company’s focus on customer satisfaction has resulted in high customer equity and long-term profitability.

3. Starbucks

Starbucks is renowned for its customer loyalty program, which rewards customers for their purchases and encourages repeat visits. Starbucks has been able to increase customer retention by offering personalized rewards and incentives. The company’s focus on building relationships with customers has led to strong customer equity and sustainable growth.

4. Netflix

Netflix is a great example of a company that leverages customer data to enhance the customer experience and drive customer engagement. Through in depth analysis of customer’s viewing habits, Netflix is able to recommend customized content. The company’s focus on personalization has led to a high level of customer equity and continued success in the streaming industry.

Scale up your Revenue with Customer Equity

In conclusion, building customer equity is essential for scaling up revenue in any business. By focusing on creating loyal customers who value your products or services, you can increase sales, drive word-of-mouth marketing and ultimately improve your bottom line.

Understanding the lifetime value of your customers and investing in strategies to enhance their experience, can cultivate a base of loyal supporters who will continue to choose your brand over the competition. So, prioritize customer equity in your marketing efforts and watch as your revenue grows along with your customer relationships.