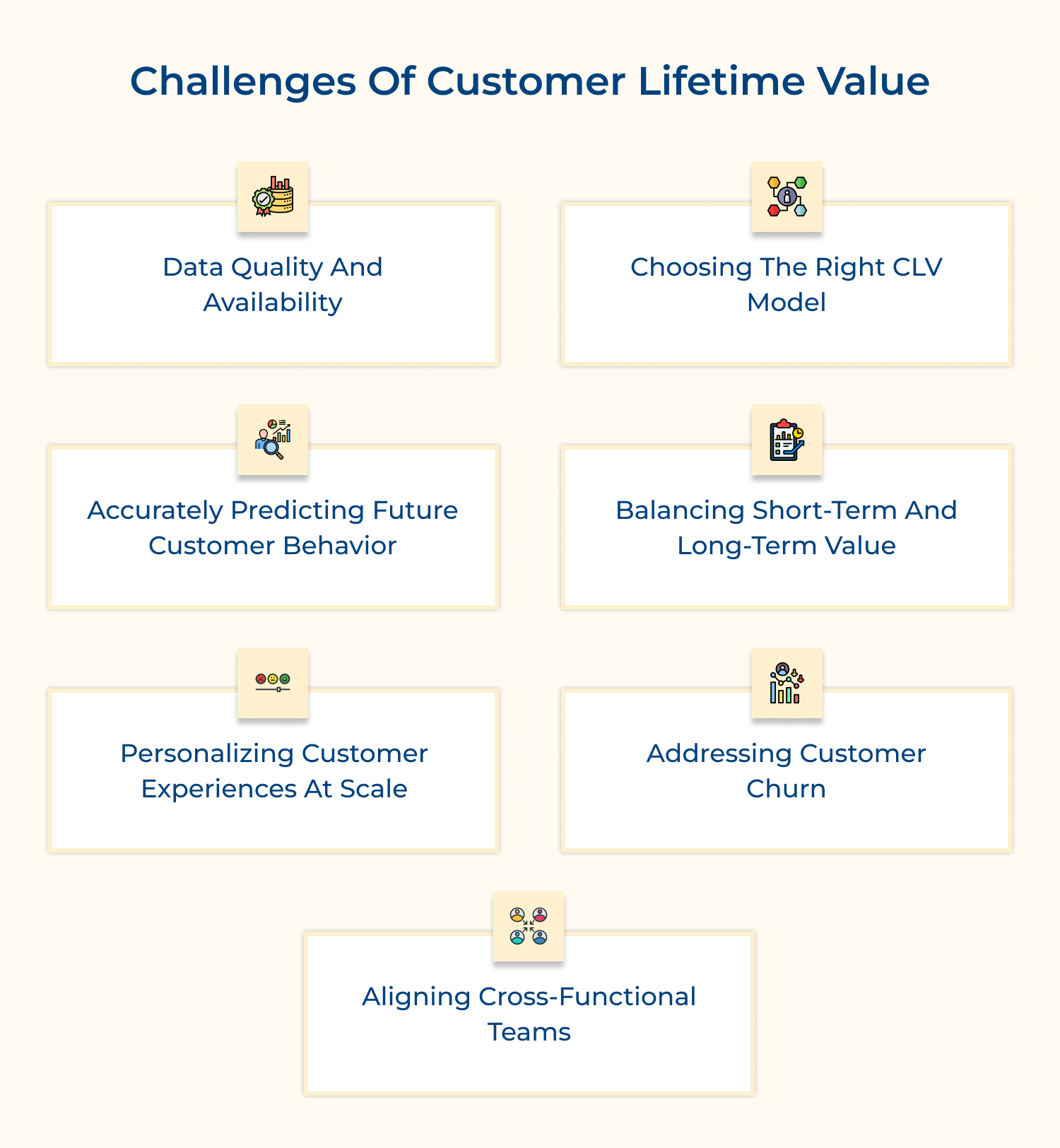

1. Data Quality and Availability

Challenge: Many organizations struggle with incomplete, inaccurate, or siloed customer data. It hampers the ability to calculate CLV accurately and derive meaningful insights. Poor data quality can lead to misguided strategies and ineffective decision-making.

Solution: Implement a robust data management strategy. Invest in data cleansing tools and processes to ensure data accuracy. Integrate data from various touch points into a centralized Customer Data Platform (CDP). Regularly audit and update data collection methods. Train staff on the importance of data quality and proper data entry procedures.

2. Choosing the Right CLV Model

Challenge: Selecting an appropriate CLV model can be daunting. Different models suit various industries and business types. Using an unsuitable model may lead to inaccurate predictions and misallocation of resources.

Solution: Research and compare different CLV models to find the best fit for your business. Consider factors like industry type, sales cycle and available data. Start with a simple model and gradually increase complexity as you gather more insights. Regularly validate and refine your model based on actual results.

3. Accurately Predicting Future Customer Behavior

Challenge: Forecasting future customer behavior is inherently challenging due to changing market conditions, evolving customer preferences and unforeseen external factors. Inaccurate predictions can lead to misguided strategies and resource allocation.

Solution: Utilize advanced predictive analytics and machine learning algorithms to improve forecast accuracy. Incorporate a wide range of data points, including historical purchase data, engagement metrics and external market factors. Regularly update and retrain your models with new data. Implement scenario planning to account for various possible future outcomes.

4. Balancing Short-term and Long-term Value

Challenge: Companies often struggle to balance short-term revenue goals with long-term customer value. Focusing too heavily on immediate gains can negatively impact customer relationships and future CLV.

Solution: Develop a balanced scorecard that includes both short-term and long-term metrics. Educate leadership on the importance of CLV and its impact on sustainable growth. Implement incentive structures that reward both immediate results and long-term customer value creation. Regularly review and adjust strategies to maintain this balance.

5. Personalizing Customer Experiences at Scale

Challenge: While personalization is crucial for increasing CLV, implementing tailored experiences for a large customer base can be complex and resource-intensive. Balancing personalization with efficiency is a common struggle.

Solution: Leverage AI and machine learning technologies to automate personalization at scale. Implement a robust customer segmentation strategy to create targeted experiences for different groups. Utilize dynamic content in marketing communications. Invest in technologies that enable real-time personalization across various touchpoints.

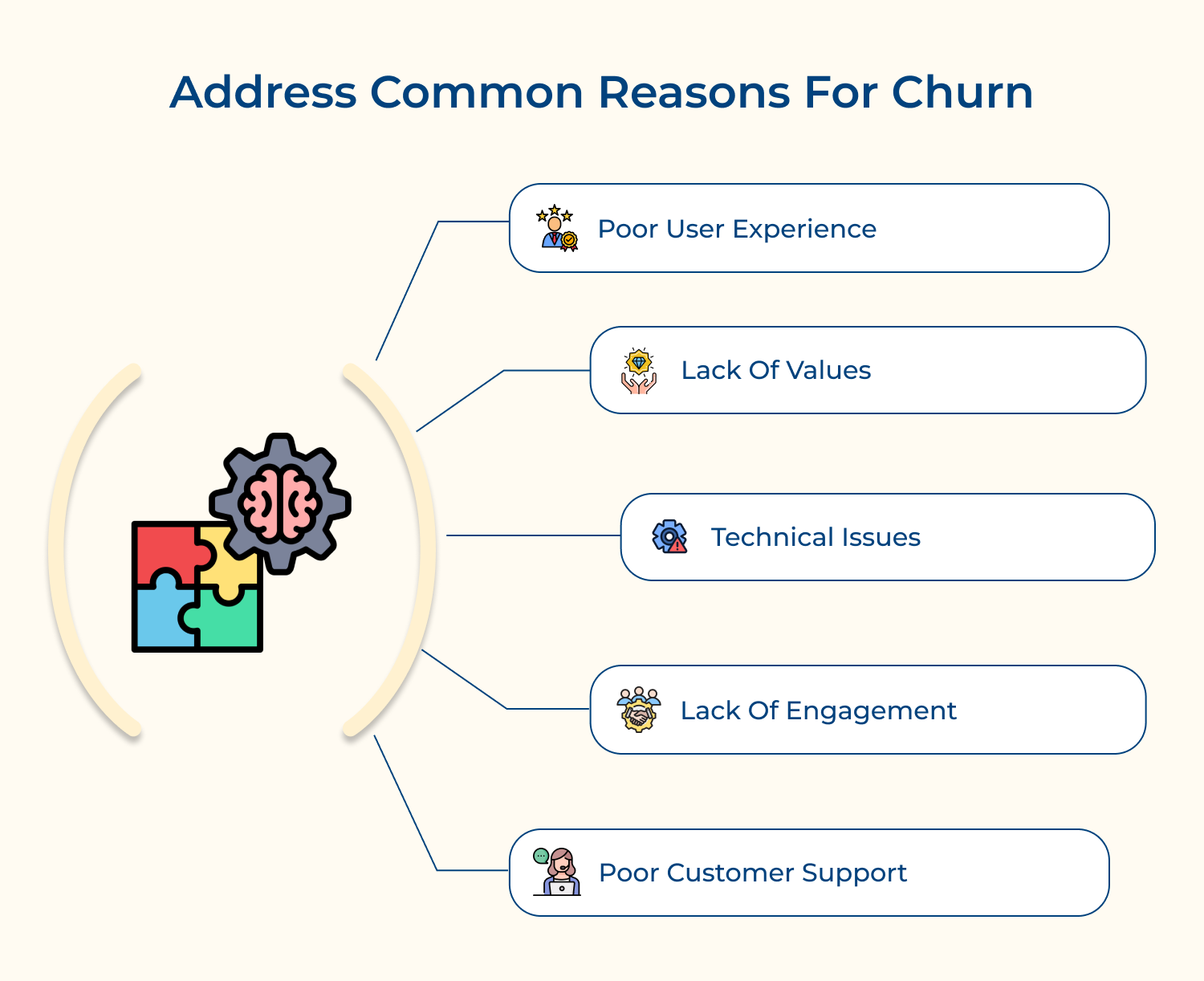

6. Addressing Customer Churn

Challenge: High customer churn rates can significantly impact CLV. Identifying at-risk customers and implementing effective retention strategies in a timely manner is often difficult for businesses.

Solution: Develop predictive churn models to identify at-risk customers early. Implement proactive retention programs targeting these customers. Create a systematic feedback loop to understand and address reasons for churn. Offer personalized incentives or value-added services to high-risk, high-value customers. Continuously analyze churn patterns to refine retention strategies.

7. Aligning Cross-functional Teams

Challenge: Maximizing CLV requires collaboration across various departments, including marketing, sales, customer service and product development. Silos and misaligned objectives can hinder efforts to improve CLV.

Solution: Create a cross-functional CLV task force with representatives from all relevant departments. Develop shared KPIs tied to CLV improvement. Implement regular cross-departmental meetings to discuss CLV strategies and progress. Use collaborative tools to share customer insights across the organization. Align incentives across departments to encourage cooperation in improving CLV.

Real-World Examples and Case Studies of CLV

Customer Lifetime Value (CLV) provides crucial insights into long-term profitability. Here are five real-world examples and case studies showcasing its impact.

1. Amazon Prime

Amazon has masterfully increased CLV through its Prime membership program. By offering benefits like free shipping, streaming services and exclusive deals. Amazon encourages repeat purchases and increases customer loyalty. The company reported that Prime members spend an average of $1,400 per year, compared to $600 for non-members.

Key strategy: Bundling services to create a comprehensive value proposition that keeps customers engaged across multiple touchpoints.

2. Starbucks Rewards Program

Starbucks’ mobile app and rewards program have significantly boosted CLV. The app allows for easy ordering, payments and personalized offers. By gamifying the experience with stars and levels, Starbucks incentivizes frequent visits. The program now accounts for over 40% of U.S. sales, with members visiting more often and spending more per visit.

Key strategy: Leveraging technology to create a seamless, personalized experience that encourages frequent engagement.

3. Dollar Shave Club

Dollar Shave Club disrupted the razor industry by focusing on a subscription model. By offering convenient, regular deliveries of quality razors at affordable prices, they’ve built a loyal customer base with high CLV. The company grew to a $1 billion valuation within five years by prioritizing customer retention and recurring revenue.

Key strategy: Simplifying the customer experience through a subscription model, reducing friction for repeat purchases.

4. Chewy

Online pet retailer Chewy has excelled at increasing CLV through exceptional customer service. They’re known for sending personalized handwritten notes, custom pet portraits and even sympathy flowers when a customer’s pet passes away. This level of care creates strong emotional connections, leading to high customer loyalty and positive word-of-mouth. Chewy’s CLV is estimated to be over $700 per customer.

Key strategy: Investing in customer service to create emotional bonds and drive loyalty.

5. Sephora Beauty Insider

Sephora’s Beauty Insider program is a tiered loyalty system that offers increasing benefits based on annual spend. It includes personalized product recommendations, exclusive events and early access to new products. The program has over 25 million members, who account for about 80% of Sephora’s annual sales. By offering experiential rewards alongside points, Sephora keeps customers engaged and spending more over time.

Key strategy: Creating a tiered loyalty program that incentivizes increased spending and engagement over time.

Transforming Customer Relationships into Revenue: A CLV Approach

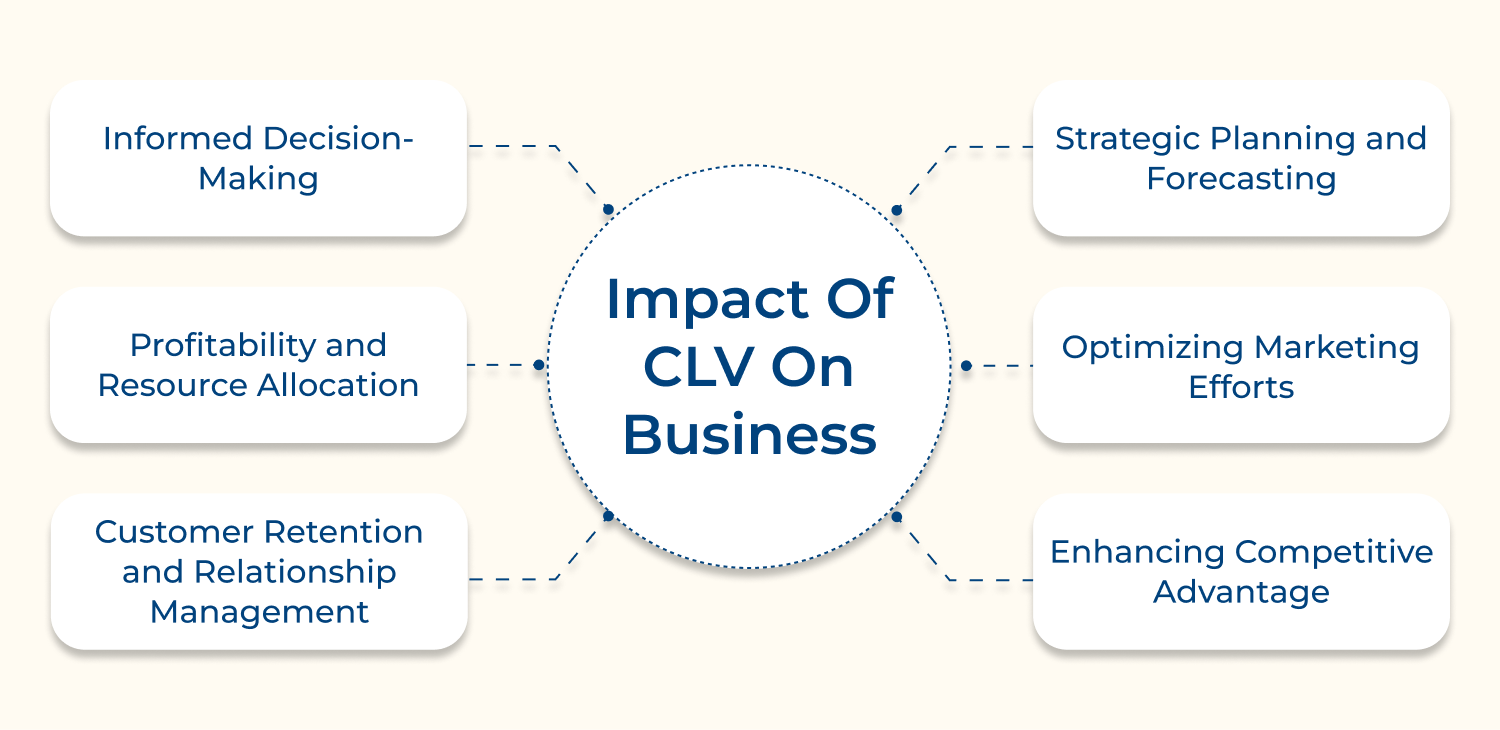

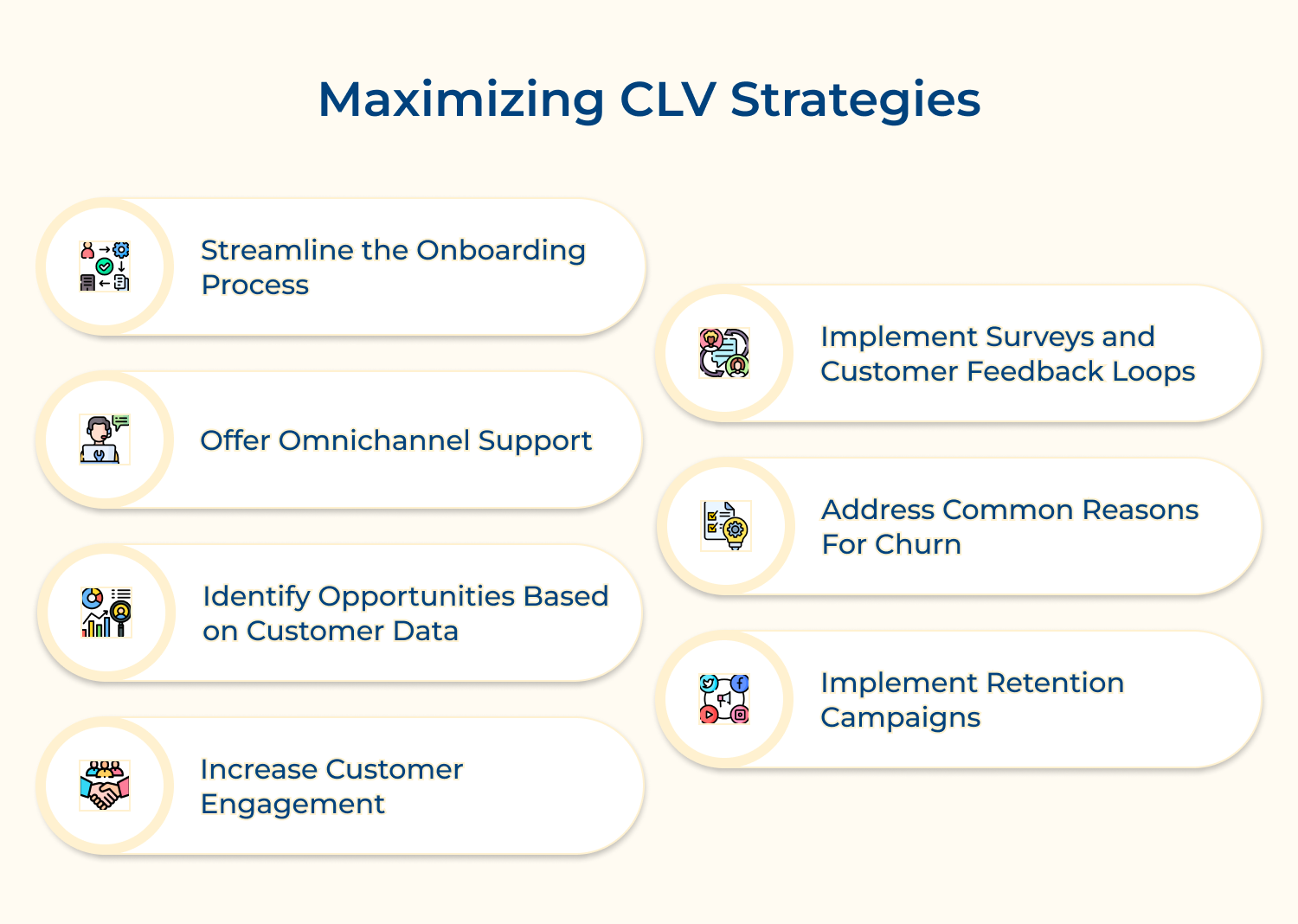

Increasing Customer Lifetime Value (CLV) is essential for sustainable business growth and profitability. By focusing on strategies such as enhancing customer experience, implementing effective retention programs and leveraging data-driven insights, businesses can significantly boost CLV.

Understanding CLV enables companies to allocate resources efficiently, tailor marketing efforts and build long-term customer relationships. Investing in strategies that enhance CLV not only maximizes revenue but also fosters customer loyalty and advocacy, driving continued success. Prioritizing CLV ultimately leads to a more profitable and resilient business model.