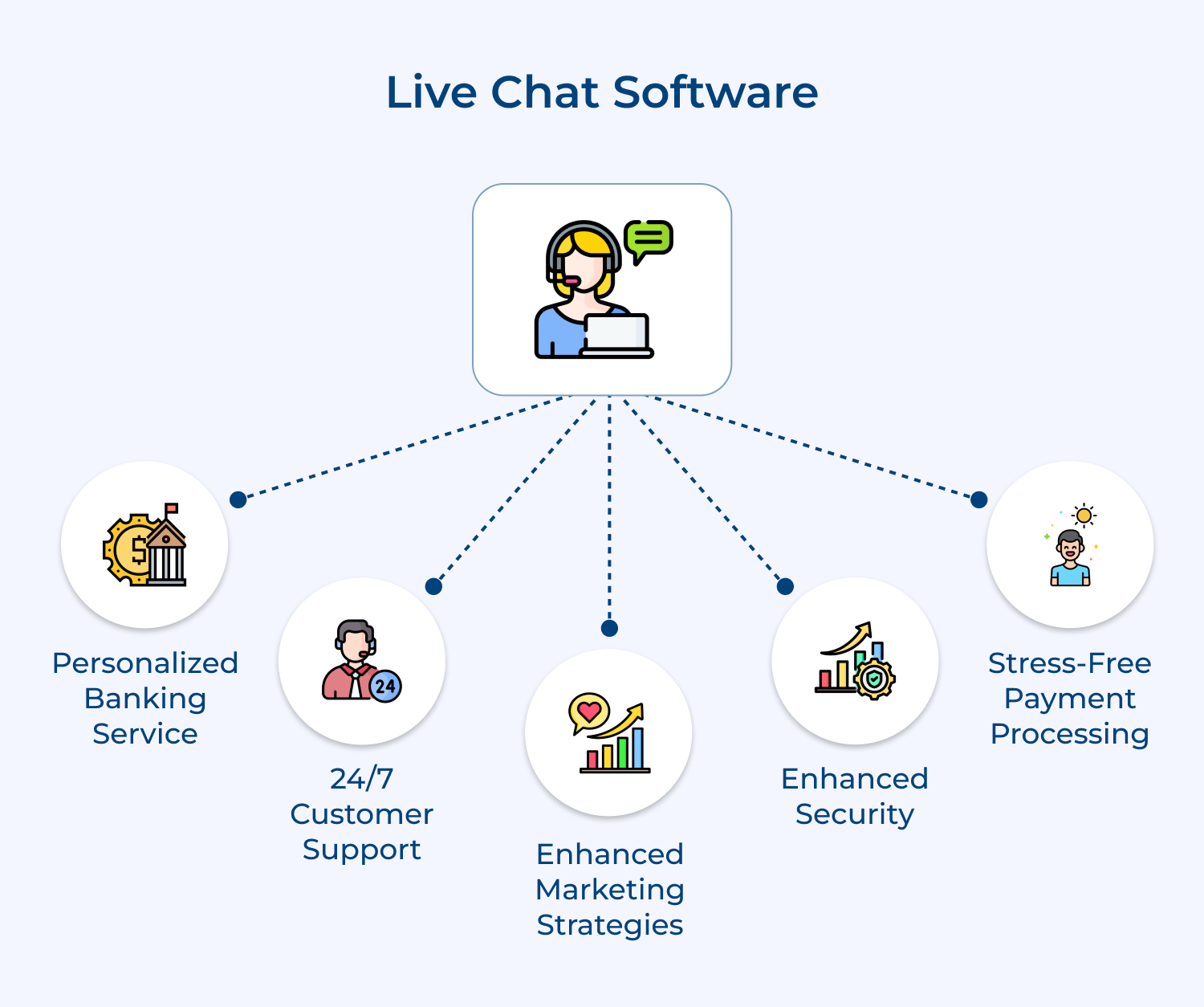

The tool allows customers to quickly get in touch with support representatives, ask questions, and receive timely responses. Live chat software also enables companies to provide proactive assistance, leading to a better overall customer experience.

3. Help Desk Software

Help desk software is essential for managing customer inquiries and complaints efficiently. The tool allows banking & finance companies to track, prioritize and resolve customer issues in a timely manner. Help desk software also enables companies to automate certain processes, provide self-service options, and improve overall customer satisfaction.

4. Social Media Management Tools

Social media has become a crucial channel for customer service in the banking and finance industry. Social media management tools help companies respond to customer queries, comments and complaints across various social media platforms. These tools also enable companies to analyze customer sentiment, track brand mentions and engage with clients in real-time.

5. Knowledge Base Software

Knowledge base software is essential for providing self-service options to clients. By creating a comprehensive knowledge base with frequently asked questions, tutorials, troubleshooting guides, banking and finance companies can empower customers to find solutions to their issues independently. It not only reduces the workload on customer service agents but also enhances the overall customer experience.

Examples of Customer Service Banking

Many banks go the extra mile to provide exceptional customer service, and here are a few real-life examples of companies that excel in this area.

USAA

USAA is consistently ranked as one of the top companies for customer service in the banking industry. They are known for their personalized service, quick response times and willingness to go the extra mile for their customers. USAA offers a variety of services for military members and their families. They are dedicated to providing the best possible experience for their customers.

Ally Bank

Ally Bank is an online-only bank that has built a reputation for excellent customer service. They offer 24/7 customer support and have a team of knowledgeable representatives who are able to assist with any banking needs. Customers appreciate the convenience of Ally Bank’s customer service and the company consistently receives high marks for their responsiveness.

Capital One

Capital One is another bank that is known for its commitment to providing top-notch customer service. They offer a variety of banking products/services, and their customer service team is always available to assist with any questions or concerns. Capital One has invested in technology to improve the customer experience, including virtual assistants and online chat support, making it easy for customers to get the help they need efficiently.

TD Bank

TD Bank has a strong focus on customer service and has won numerous awards for their commitment to providing excellent customer experiences. They offer a variety of services to meet their customers’ needs and have a team of dedicated employees who are trained to go above and beyond for their customers. TD Bank prides itself on building relationships with customers and ensuring they feel valued.

Make Exceptional Service a Priority and Watch Your Institution Thrive

Providing exceptional service is crucial for differentiating your institution from competitors in today’s competitive market. By focusing on exceeding customer expectations, building strong relationships and consistently delivering value, you can create a loyal customer base that will help drive success for your institution.

Remember that every interaction with customers is an opportunity to showcase your commitment to excellence and stand out from the competition. So, make sure to prioritize exceptional service in every aspect of your institution to set yourself apart and thrive in the ever-evolving business landscape.