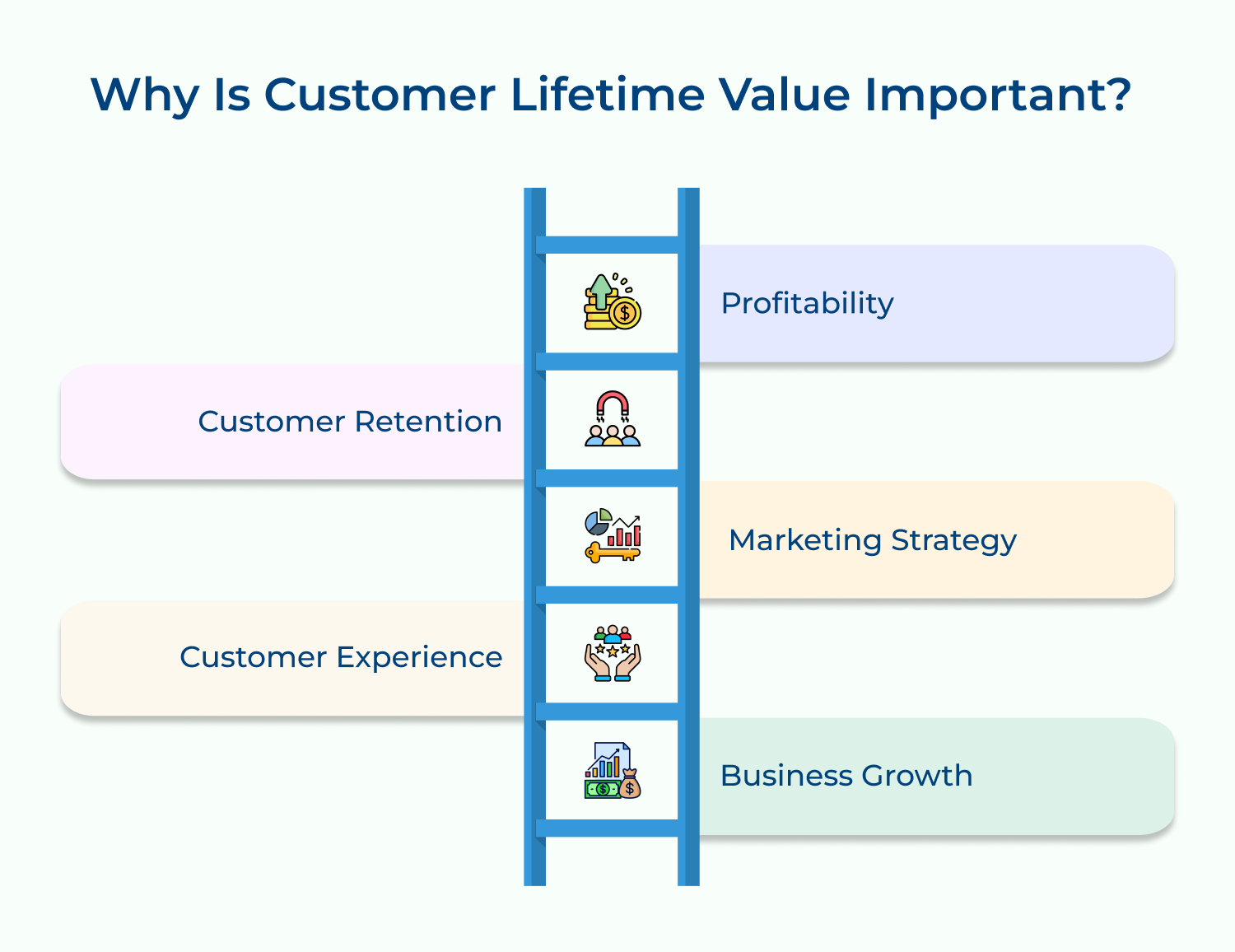

1. Profitability: Understanding the lifetime value of a customer allows businesses to focus their marketing & sales efforts on acquiring and retaining high-value customers. By investing in these customers, businesses can increase their revenue and profitability.

2. Customer retention: CLV highlights the importance of building long-term relationships with customers. By nurturing relationships with high-value customers, businesses can improve customer retention rates and reduce churn. This can lead to increased customer satisfaction and loyalty, as well as lower costs associated with acquiring new customers.

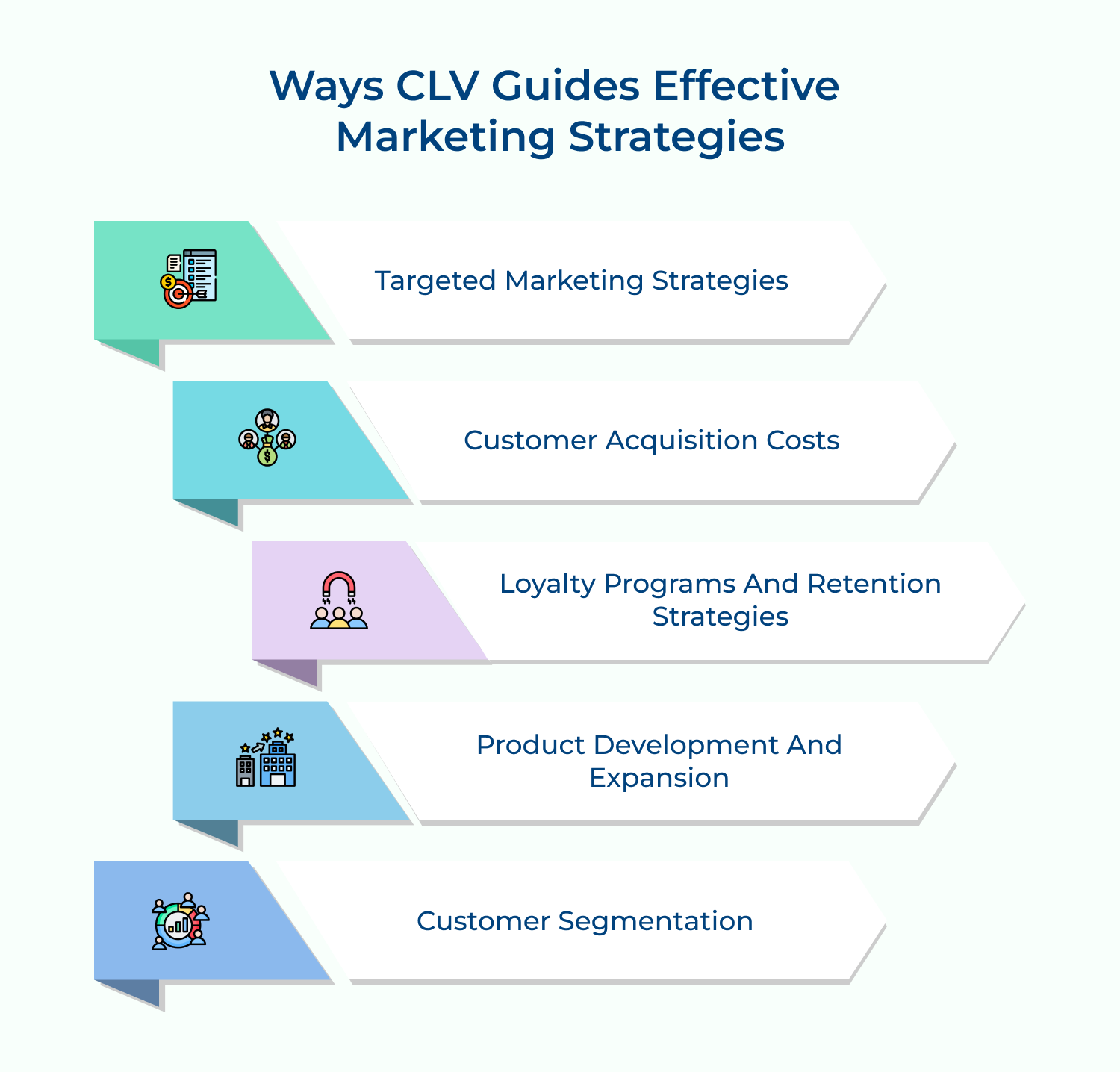

3. Marketing strategy: Knowing the lifetime value of a customer enables businesses to tailor their marketing strategies to target high-value customers. By segmenting customers based on their CLV, businesses can personalize marketing campaigns, offers and communication to better meet the needs of their most valuable customers.

4. Customer experience: Understanding CLV can also help businesses improve the overall customer experience. By identifying high-value customers, businesses can provide personalized service, rewards and incentives to enhance customer satisfaction. This can lead to increased customer engagement and repeat purchases.

5. Business growth: Increasing customer lifetime value can drive business growth and long-term success. By focusing on building relationships with high-value customers, businesses can not only increase revenue but also create advocates who can help attract new customers through referrals and recommendations.

Examples of Customer Lifetime Value

Customer Lifetime Value (CLV) is a crucial metric for businesses to understand, as it helps determine the long-term value each customer brings to the company. By analyzing CLV, businesses can make informed decisions regarding marketing strategies, customer retention efforts and overall profitability.

Costco

Costco’s membership model encourages customer loyalty and repeat visits. By offering exclusive deals and discounts to members, Costco incentivizes customers to renew their memberships year after year, resulting in a high CLV.

Lululemon

Lululemon’s focus on building a strong brand community and providing high-quality athletic apparel has cultivated a loyal customer base. The company’s in-store experiences and commitment to customer service contribute to a high CLV.

Tesla

Tesla’s innovative electric vehicles, coupled with its over-the-air software updates and unique brand appeal, have created a loyal customer base. The company’s focus on customer experience and long-term ownership costs contribute to a high CLV.

Netflix

Netflix’s subscription-based model and continuous addition of new content help retain customers for extended periods. The company’s personalized recommendations and user experience also contribute to customer satisfaction and a high CLV.

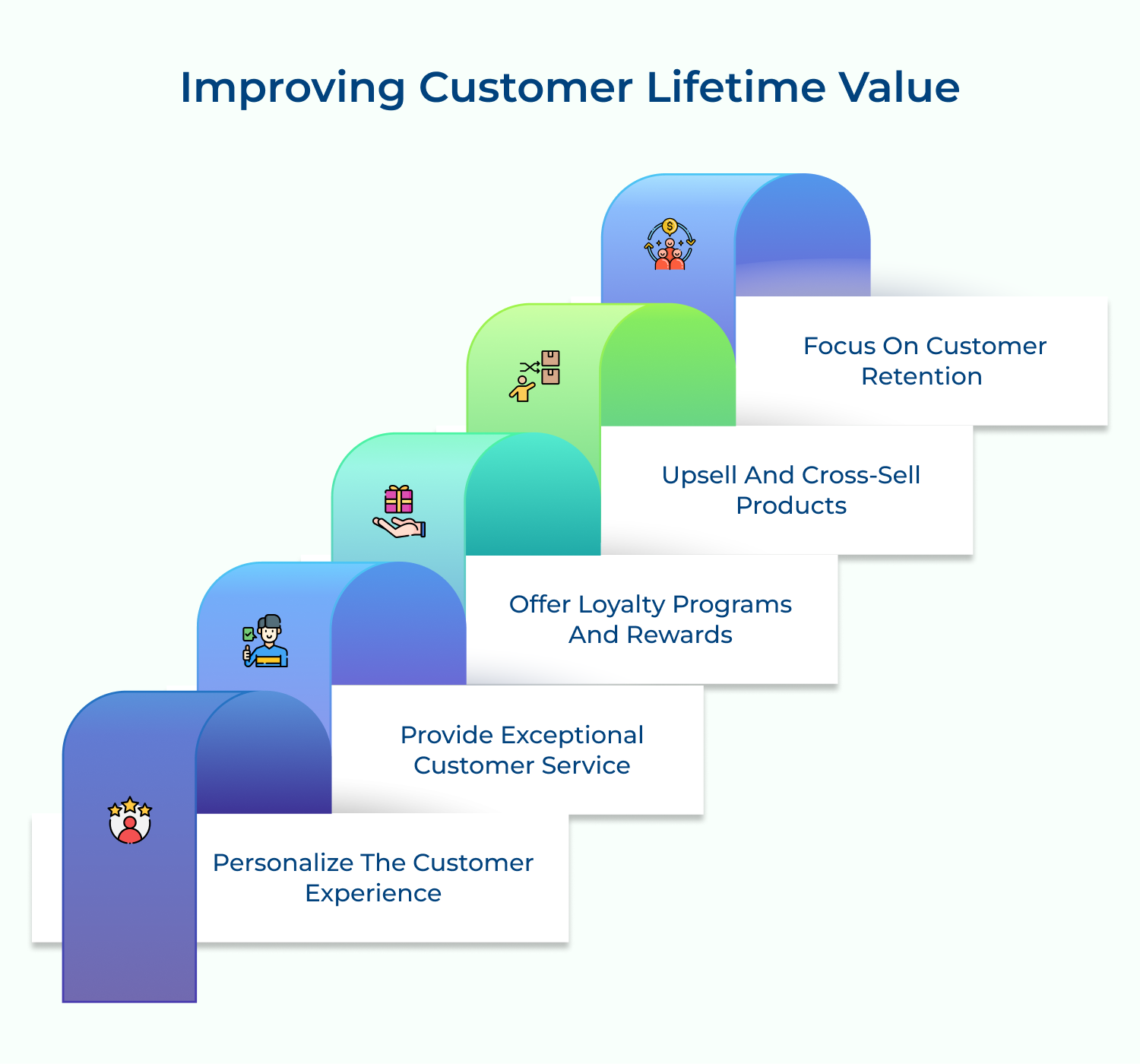

How to Improve Customer Lifetime Value (CLV)?

CLV measures the total worth a customer brings over the course of their relationship with a business. Focusing on CLV helps boost profitability and foster long-term customer loyalty.